“My Paycheck Isn’t Family Welfare”: Standing Up to Entitled Requests for College Fees

You finally got your first real paycheck. Big milestone. You even did the responsible thing—treated your parents with a gift. They were happy, proud, and grateful. And then… your aunt showed up.

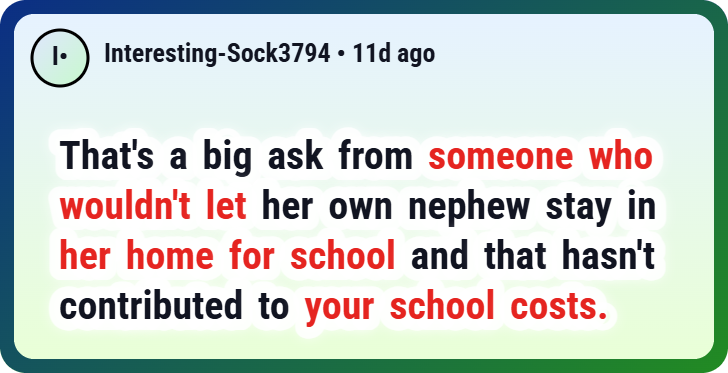

She found out about your job and instantly started demanding you pay part of your cousin’s school fees. Mind you, she earns way more than you. She also refused to help you out when you needed a place to stay. Now suddenly, your income is her solution? That’s not just entitled—that’s straight up unfair.

Advertisement – Continue Reading Below

Here’s the thing: you’re not obligated to cover your cousin’s education. That’s your aunt’s financial responsibility, not yours. You’re already handling rent, groceries, and saving for college—all important steps in building financial independence. Throwing away your hard-earned money because of family guilt trips isn’t good money management and it will hold you back from reaching your own goals.

Setting boundaries in families is tough, especially when it comes to money. But this is one of those moments where you need to stand firm. You’ve worked hard for that paycheck. It’s meant to build your future, not patch up the poor financial choices or entitlement of someone else.

Bottom line? You’re not selfish. You’re smart. And protecting your income now will help you build long-term stability, freedom, and the life you’re working so hard to create.

Some relatives can ignore your birthday for years but smell your paycheck faster than a bloodhound at a barbecue

Advertisement – Continue Reading Below

One young man’s aunt remembered he existed after hearing about his new job, and asked him to pay her son’s college fees

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

1. You Don’t Owe Your Family Your Paycheck

You worked hard for that paycheck. That’s your money. Not your aunt’s. Not your cousin’s. Yours.

Redditors in similar stories say the same thing: you’re an adult, you decide where your income goes. Personal finance experts also agree—your paycheck is tied to your financial goals, not family guilt trips. Your aunt demanding a cut for your cousin’s school fees isn’t love. It’s entitlement.

2. Setting Healthy Financial Boundaries

Here’s the deal—money boundaries in families are tough, but necessary. Experts always say, think about your own budget and goals first. Rent, food, and saving for college come before someone else’s bills. That’s not selfish—it’s smart money management.

Advertisement – Continue Reading Below

You’re not a free ATM. You’re a young adult building financial independence. And that deserves respect.

3. Reciprocity Doesn’t Mean Unlimited Obligation

Social psychology talks about the norm of reciprocity—you help when someone has helped you. But your aunt? She didn’t offer you shelter. She didn’t help with your education. She didn’t even support you when you needed it.

So why should you sacrifice your financial stability for her kid’s tuition? That’s not reciprocity. That’s a one-way street.

4. Entitlement Isn’t Family Support

Plenty of people online share the same kind of story—relatives demanding money just because “family helps family.” But toxic family dynamics often hide behind that phrase. Helping should be a choice, not an obligation.

Your aunt earns more than you. She refused to help when you needed it. Now she expects you to carry her financial responsibility? That’s not family love. That’s manipulation.

Advertisement – Continue Reading Below

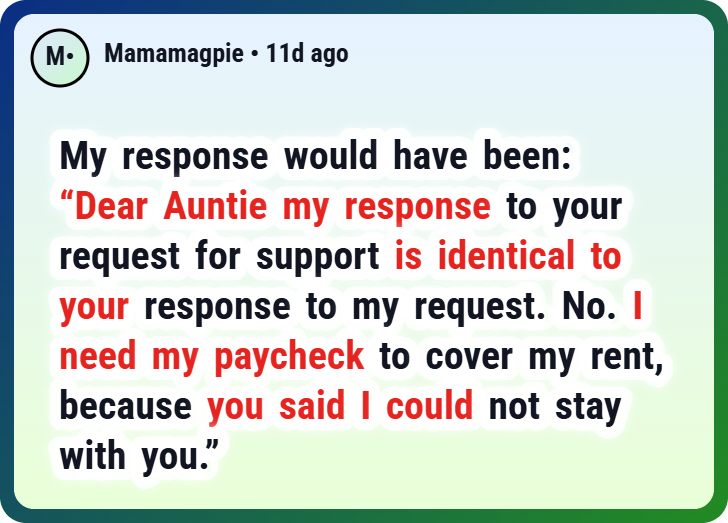

5. Respectful Boundaries Cut Through Guilt

You already did the right thing. You explained your expenses, your goals, and your priorities. That’s clear communication and it shows maturity.

Advertisement – Continue Reading Below

If you ever need to repeat yourself, keep it simple:

“I understand, but my paycheck goes to rent, food, and saving for my education. I can’t help financially right now.”

Advertisement – Continue Reading Below

Short, polite, and final. You don’t owe her a 10-slide PowerPoint on your budget.

6. When Family Pressure Becomes Financial Drain

There’s even a word for this in cultural psychology—humbugging. It’s when relatives guilt or pressure you into handing over money without respecting your boundaries. And it’s draining—financially and emotionally.

Remember: you’re not a bank. You don’t have to sacrifice your financial health just to keep someone else comfortable.

Advertisement – Continue Reading Below

7. Protecting Your Self-Sufficiency

This isn’t about rejecting family. It’s about protecting your future. Financial independence for young adults is fragile—you’re just starting out. Every paycheck matters.

Advice columnists often say: be honest, set the boundary, and stick to it. You’ve already done that. You politely declined, you didn’t fight, you even stepped back when the pressure got too much. That’s strength. That’s clarity.

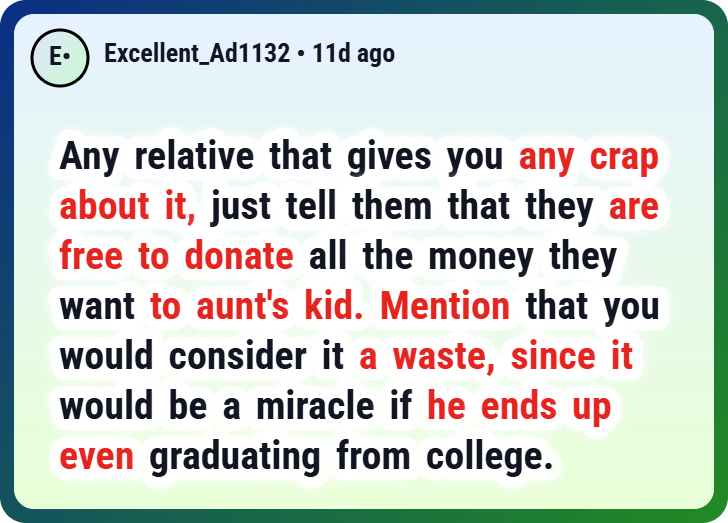

Netizens side with the man, saying he should suggest his aunt ask her son to get a job and pay for school himself

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

Advertisement – Continue Reading Below

You’re not the asshole.

You’re a young adult working hard, paying your bills, saving for college, and building your independence. That comes first. Always.

Advertisement – Continue Reading Below

Your aunt’s demand wasn’t love—it was entitlement. And saying no doesn’t make you selfish. It makes you smart.

You’re protecting your paycheck, your mental health, and your future. And honestly? That’s the most responsible financial decision you could make.